Estate Planning · December 27, 2024

If you're like most people, you most likely own numerous digital assets, some of which may have significant monetary value and some which have purely sentimental value. You may also own digital assets which hold no value for anyone other than yourself or have a certain digital property that you'd prefer your family and friends not access or inherit when you pass away. To ensure all your digital assets are passed on according to your wish, you must adapt your estate planning strategies.

Estate Planning · December 23, 2024

Recent advances in digital technology have made many aspects of our lives exponentially easier and more convenient. But at the same time, digital technology has also created some serious complications when it comes to estate planning. Without the proper estate planning, just locating and accessing your digital assets can be a major headache—or even impossible—for your loved ones following your incapacity or death.

Estate Planning · June 07, 2022

Although married same-gender couples are now enjoying nearly all of the same rights as opposite-gender couples, there is still one key right that’s still up in the air—the automatic right to be legal parents. While parental rights are automatically bestowed upon the biological parent, the non-biological spouse/parent still faces a number of challenges when it comes to obtaining full parental rights. Luckily, same-gender couples do have an alternative to adoption—estate planning.

Estate Planning · June 03, 2022

Although same-gender marriage is legally recognized in all 50 states, long-held prejudice at both political and family levels continues to create complications for married and unmarried same-gender couples. With this, especially if you're a member LGBTQ+ community, estate planning is even more critical for you and your beloved to ensure that they will be protected and provided for in the event of your death or incapacity.

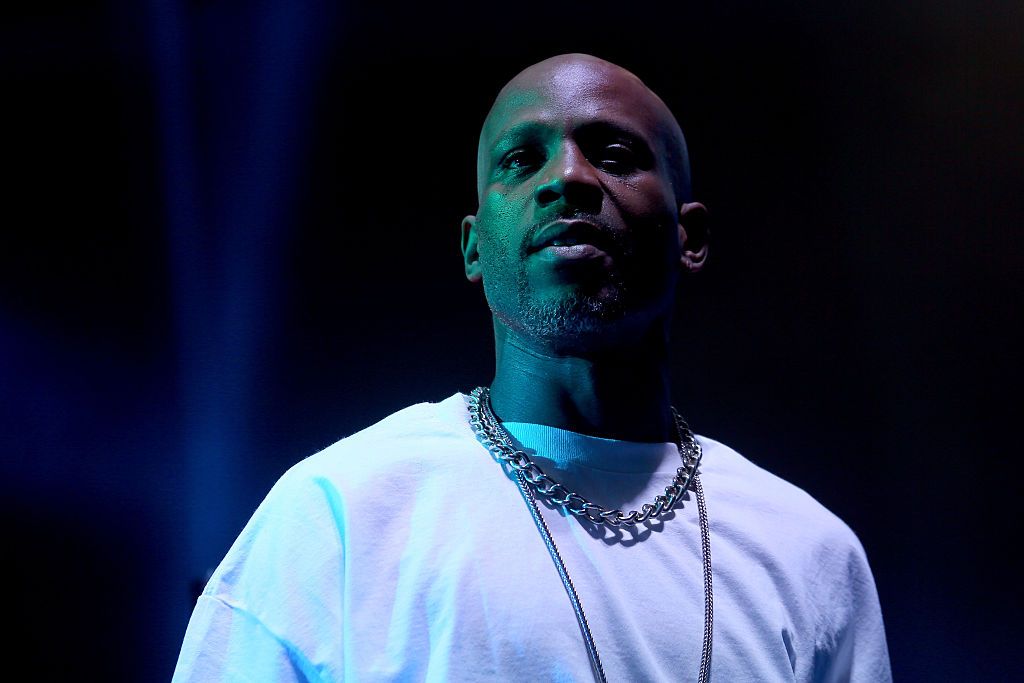

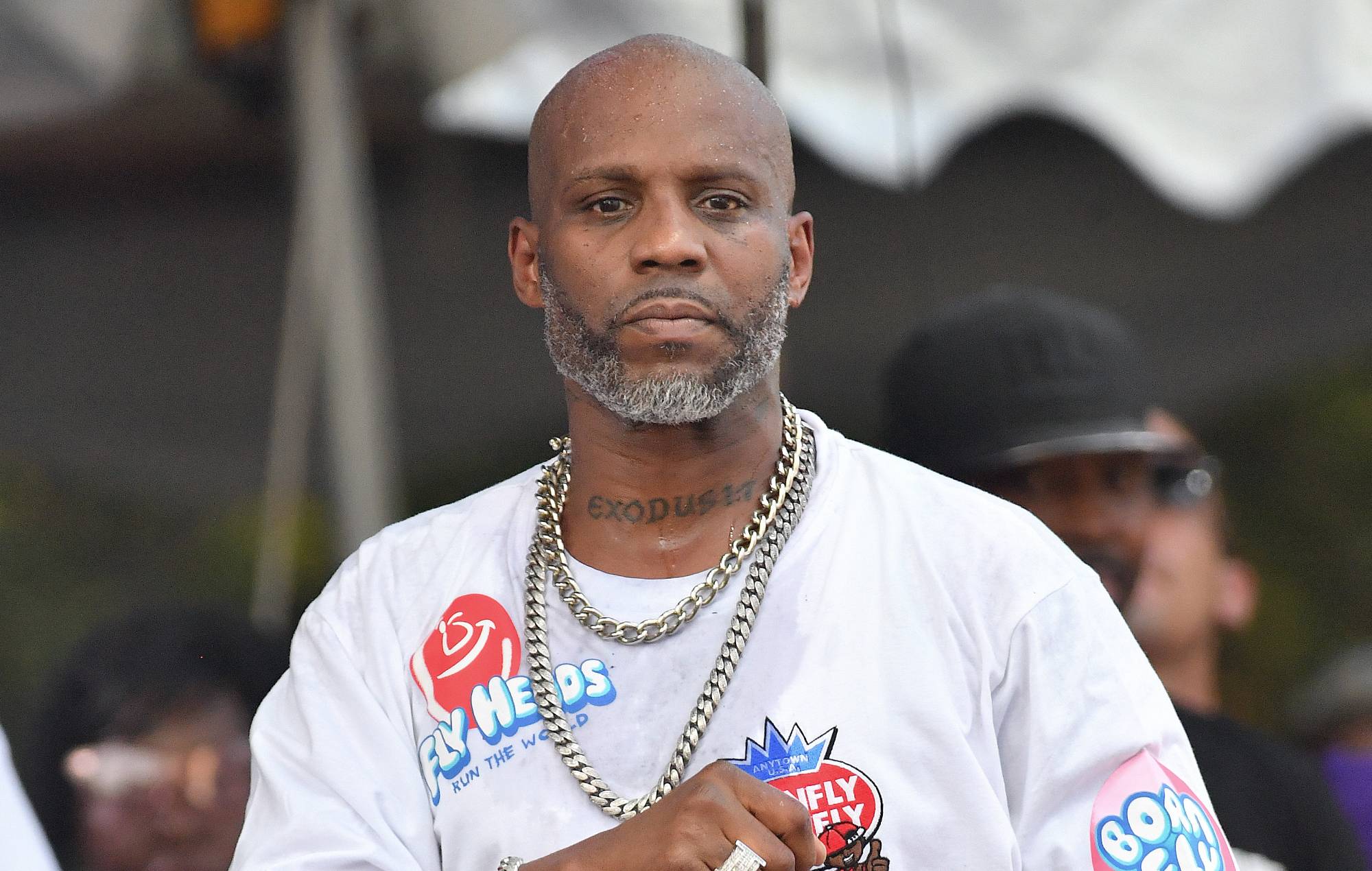

Estate Planning · August 20, 2021

Although DMX was successful in music and movies, the rap icon experienced serious legal and financial problems. His story proves that regardless of your financial status, planning for your potential incapacity and eventual death is something you should take care of, especially if you have children. The saddest part of this whole situation is that all the conflict, expense, and trauma that DMX’s loved ones are likely to endure could have been prevented with comprehensive estate planning.

Business · August 17, 2021

As more and more businesses take advantage of the benefits of using independent contractors (ICs) in lieu of full-time employees, the line between worker classification can get easily blurred. Though independent contractors can give your company an edge in today's "gig economy", but misclassifying your workers can cause you big-time in penalties, including fines, back taxes, and unpaid benefits.

Estate Planning · August 13, 2021

Legendary hip hop artist Earl Simmons, known as DMX, passed away at age 50 after suffering a heart attack. Despite selling more than 74 million albums and enjoying a wildly successful career in music and movies, DMX, who died without a will, left behind an estate that some estimates report being millions of dollars in debt. With so much wealth and so many children, his failure to create an estate plan will likely mean his loved ones will be stuck battling each other in court for years to come.

Business · August 10, 2021

Every business has its own unique risks and assets, so business insurance is your first line of defense in protecting your company from a wide variety of different potential threats. Without the right insurance—or with too little of the insurance you do need—you could be at great risk from the costs of a lawsuit, judgment, or in the event of an unforeseen emergency or disaster. There are many types of business insurance available, so make sure to know the type of insurance your business needs.

Estate Planning · August 06, 2021

It's sad but true that many pets end up in shelters after their owner dies or becomes incapacitated. In fact, the Humane Society estimates that between 100,00 to 500,000 pets are placed in shelters each year for this reason, and many of these animals are ultimately euthanized. In light of this cold reality, if you're a pet owner, the best way to avoid this tragic event is to use estate planning to ensure your pets receive the best care when you're no longer able to care for them yourself.

Business · August 03, 2021

If you've always dreamed of running your own business but find the thought of building an entire company from scratch too daunting, you might consider investing in a franchise. When you purchase a franchise, you get an already proven business model and brand, which can make the startup phase significantly easier. Also, most franchises come with turnkey operating systems, extensive training programs, and ongoing support from the franchisor. However, no business is without its risks and drawbacks.