Estate Planning · September 16, 2024

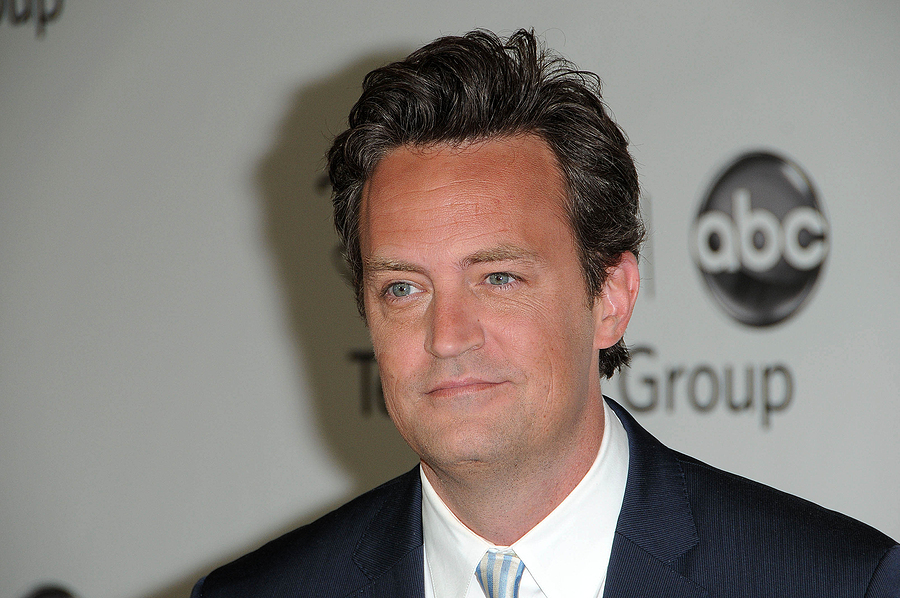

When Matthew Perry passed away, the iconic actor left behind a curious financial puzzle—despite earning millions, only a fraction of his wealth was immediately apparent. This serves as a pivotal lesson on the power of advanced estate planning, specifically the strategic use of trusts. Delve into the complexities of Perry's estate strategy and uncover how properly structured trusts not only preserve wealth but also maintain privacy, avoid costly probate, and ensure your legacy is managed accordin

Estate Planning · August 23, 2024

Imagine discovering thousands of dollars that belong to you, only to be told you can't have it. It’s called “unclaimed property,” which is money that’s yours but has been handed over to the government without your knowledge. And it happens more often than you may think. Read more…

Estate Planning · August 16, 2024

Imagine this: You're in your twenties and you fill out a form at work, naming your significant other as the beneficiary of your retirement account. Fast forward 28 years - you've long since broken up, lived a full life, and died, and your ex gets your now-million-dollar nest egg. Sound far-fetched? It's not. Read more…

Estate Planning · August 09, 2024

As a parent or grandparent, nothing is more important than securing a bright future for our children. We all dream of giving them the best education possible, but with rising tuition costs, that dream can feel increasingly out of reach. Navigating the maze of education funding options can be daunting. Without the right strategy, many families find themselves unprepared, potentially putting their child’s educational dreams on hold. It’s not just about saving; it’s about making smart, informed dec

December 12, 2022

This article will explain how to get your heirs up to speed on their finances, so the transfer of wealth goes smoothly. It doesn't matter if you live in a mansion or a small house; you can protect your family's assets and keep them from experiencing the horrors of financial incompetence. This article outlines the three steps of financial literacy, including how to talk about money with your children. Read more here:

Estate Planning · August 12, 2022

In part one of this series, we discussed 529 plans and education savings accounts, which are both popular options for saving for a college education. Do you know the main reasons for their popularity? It's their tax-saving advantage! The money you contribute to a 529 account grows on a tax-deferred basis, and withdrawals are tax-free, provided they're used for qualified education expenses, such as tuition, room and board, and other education-related fees.

Estate Planning · August 05, 2022

If you have started to save for your child or grandchild’s college education, it’s worth considering whether to use a 529 plan, an education savings account, or an Irrevocable Trust. Here’s what we think you should consider as you decide!